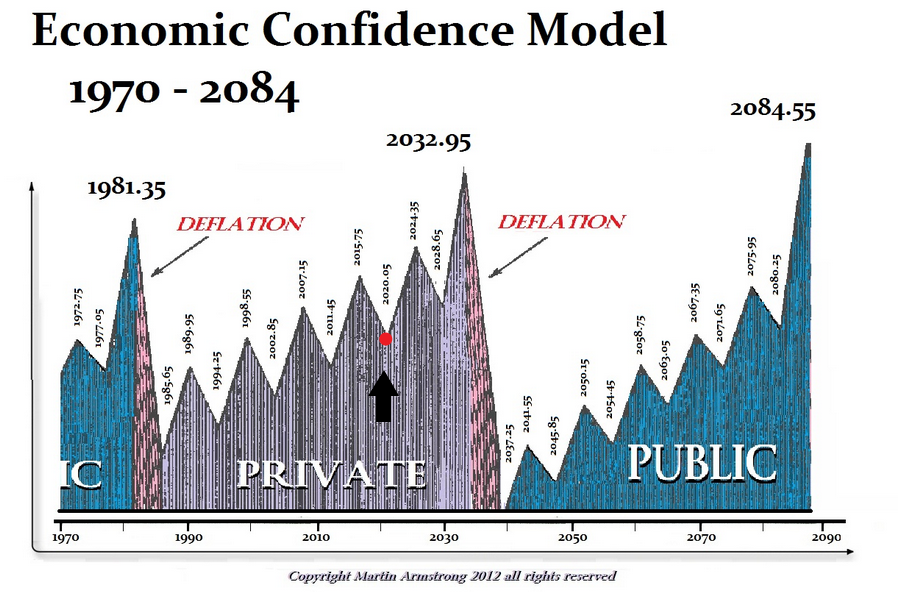

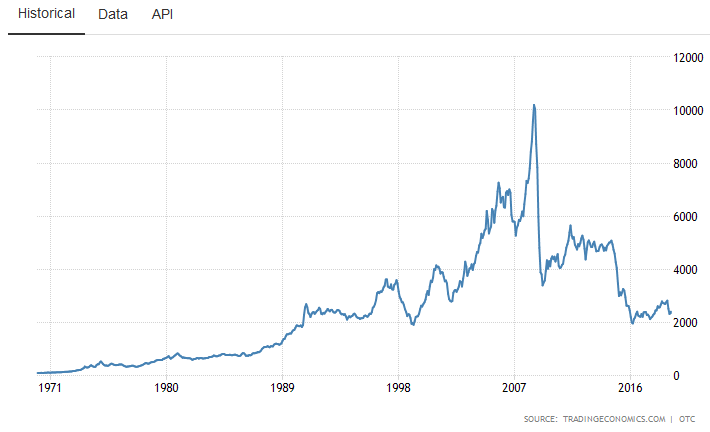

Markets can be deceiving, especially during pivots in long term trends. Corrections are mistaken for bear markets, and break-outs in long standing financial ratios are by default perceived as fragile bubbles. This can be a symptom of always looking in the rear view mirror, not fully grasping the much longer term trends and cycles at play. Cycles that span not years, but centuries. Unfortunately, even if we find charts that go back far enough, it would lack a consistent methodology and throw off any relative valuation. So some have taken to the history books. Martin Armstrong, an economic forecaster has done just that with his “economic confidence model”

A rough estimate of where we are in the model. As a model, the overall direction is more important than the exact timing.

The model denotes the dynamic between public and private assets. Like a pendulum, money swings from one sector to the other. At a certain point when one sector sucks up a huge percentage of available capital, it actually causes money velocity to freeze up, leading to temporary deflation. This makes sense, because how can the quantity of money effect the price of everyday goods and services, if that very money is locked up in real estate, bonds or stock market bubbles?

Velocity of Money = Nominal GDP/Circulating Money Supply

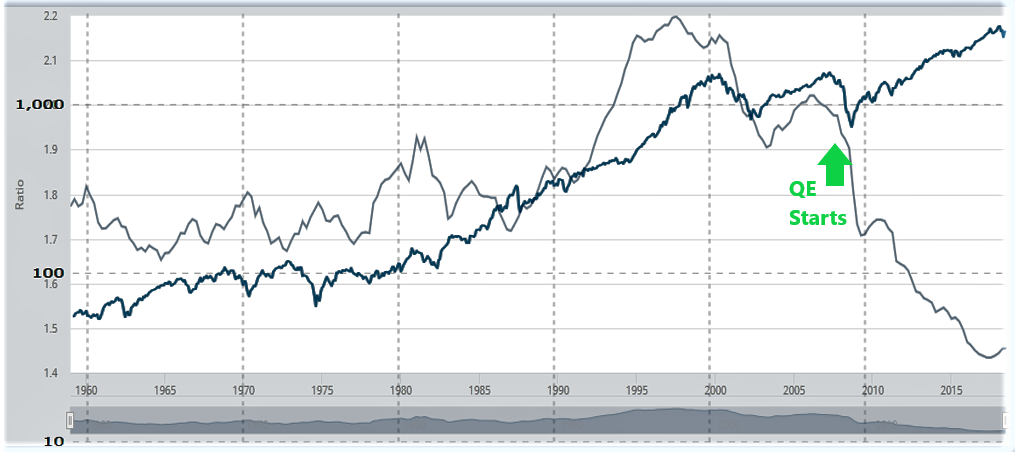

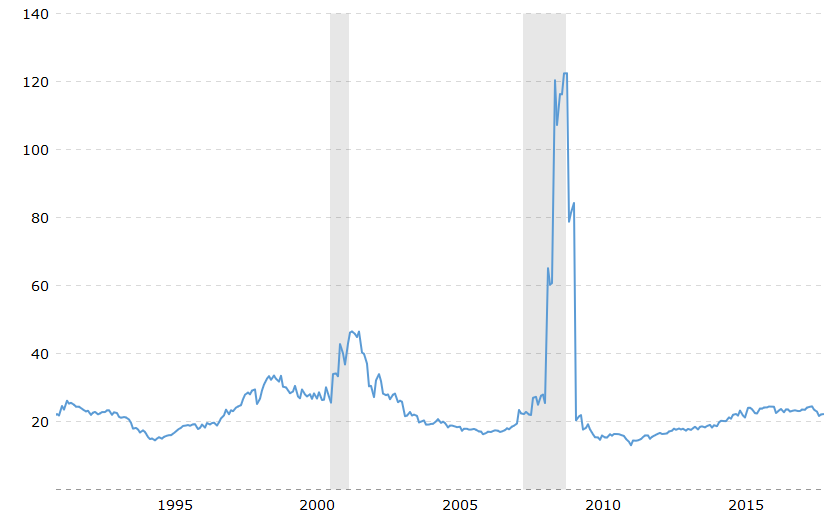

The velocity of money recently collapsed because the Fed boosted the money supply. All that cash still hasn’t had the chance to circulate. GDP growth also remains low. So, there is a good chance that the numerator will increase and the denominator will remain stable. Therefore, I argue the gap will be closed by velocity moving up, rather than stocks moving down. As you can see below, money velocity usually serves as a tailwind for stocks.

Edit: I’ve received some messages to go into more detail here. To clarify, inflation(both money supply & money velocity) are normally positively correlated with the stock market. The deflation shows up as a small, temporary correction in the economic confidence model. In my view, the fact that the correlation broke down yet the market continues to climb implies that there is still enormous pent up energy in the economy.

“In the long term, inflation is determined by the quantity of the money. In the short term, inflation is determined by the velocity of money”

Mike Maloney

According to the rough estimate of the economic confidence model, we should see continued increase in private assets such as stocks through 2032. Assets should continue to pour out of cash, treasuries, municipals, state debt and into stocks, private equity, and hard assets. We are still in the long term private asset bubble phase according to the model.

The Big Shift

It’s times like these when traditional “risk free” assets are brought into question. Below is a ratio of the S&P 500 index over U.S. 20+ Year Treasury Bonds. It has stayed below 19 for decades, and has only just exceeded this key technical level in late 2016. Many will probably see this as just another bubble. Though we should stay open to the possibility of a secular trend, not immune to significant corrections spanning months and even years.

Some may call this a bubble, others a trend

Scarred equity investors who were burned repeatedly in 2001 and 2008 are weary. Which is why they call for a secular crash. P/E ratios, Buffet Indicators, and the yield curve flattening are all hammered on as reasons to prepare for the next big short. I believe this might end up being the big bear trap instead.

Caveats you should keep in mind before going for that short play.

1. P/E ratios actually peaked after the stock market crashes of 2001 and 2008. Basically at the very bottom. P/E ratios are good tools for relative valuation of companies and industries, but NOT a very good tool for market timing.

2. Although there is much uproar by the talking heads in the financial media about the yield curve inverting. The truth is that small portion of the curve cited has very little predictive value. Furthermore, the entire yield curve has still not inverted.

3. Generally when everyone and their mother is calling for a ’08 style stock crash, the opposite is true.

4. Commodity Prices Remain Muted. Inconsistent with an economy about to roll over.

Great рost. I’ve been curious about this