The year is 2014 and the 3D printing craze is sweeping the nation. Media outlets panic about the onslaught of 3D printed guns that are sure to cause a national emergency. Others brace for the economic shock to be created by ordinary people printing everything form furniture to food to skin cells on a regular basis. Janne Kyttanen and Barack Obama were saying it’s “nothing less than the start of a new industrial revolution” and that the tech “has potential to change how we make almost everything”

So what went wrong? Nothing ostensibly. The 3D printing market has certainly grown since then, but 5 years later, it clearly hasn’t lived up to the hype. It seems in these technological hype cycles, even the most level headed proponents still seem to overestimate the adoption rate. So how far has the industry gone in terms of dollars and cents? Below we will look at four popular 3D printing stocks at the 2014 peak and see how they’re faring now.

1. Stratasys Ltd.

This company was given high marks due to its website Thingiverse, which was anticipated to be the Amazon of all things 3D printed. However, after 5 years the marketplace has remained just a small community of tinkerers. The company also produces printers themselves for office prototyping.

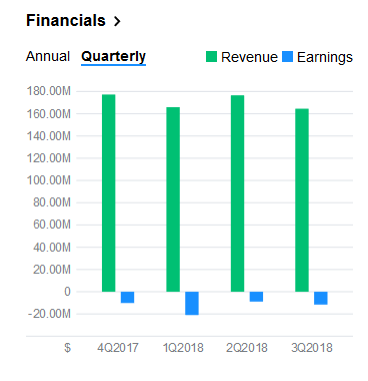

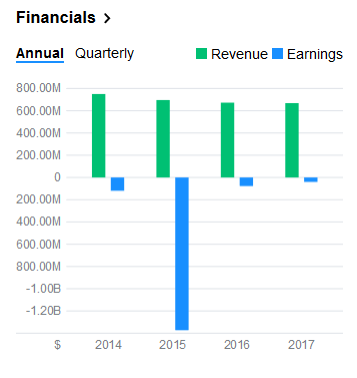

Profit and revenue numbers haven’t improved at all since 2014. Although the company has pointed towards new global partnerships, we still have yet to see if this will bear fruit

Since the price is all the way back down below 2007 levels I thought I could use that common price point as a baseline for comparison. The only metric that made positive progress since then was revenue. On all other metrics the numbers actually got worse, such as net profit, debt/equity ratio and operating margin. After over ten years of operation, the company has made more than a step in the wrong direction.

Proto Labs, Inc.

Proto Labs, Inc., together with its subsidiaries, operates as an e-commerce enabled digital manufacturer of custom parts for prototyping and fast-run production worldwide. It utilizes injection molding, computer numerical control machining, three-dimensional (3D) printing, and sheet metal fabrication to manufacture custom parts for developers and engineers who use 3D computer-aided design software to design products across a range of end markets. The company stands in stark contrast to many of its failing peers. The company has been in expansion mode, opening up a new manufacturing facility last year.

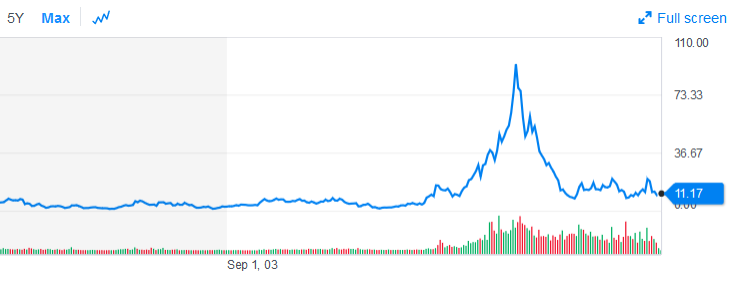

The stock’s price movement matches its steady increase in revenue and earnings. The company has a low amount of debt and has partnered with MIT for the founding of the Center for Additive and Digital Advanced Production Technologies last year.

The stock has certainly performed much better than its peers and might be one of the few good buys in the sector.

3D Systems Corporation

3D Systems Corporation, through its subsidiaries, provides three-dimensional (3D) printing products and services worldwide. The company offers 3D printers, such as stereolithography, selective laser sintering, direct metal printing, multi jet printing, and color jet printers that transform data input generated by 3D design software, CAD software, or other 3D design tools into printed parts under the Accura, DuraForm, LaserForm, CastForm, and VisiJet brand names. The company has recently released its new Photogrammetry System, and figure four 3D printer system.

This stock has also been in revenue and earnings stagnation over the past few quarters. Again, here’s another 3D printing company that has not been able to get by in this competitive, saturated market. Too many similar printers have crowded out the same segment and will have to be cleared out.

Arc Group Worldwide

ARC Group Worldwide, Inc. provides metal injection molding and metal 3D printing solutions globally. The Precision Components Group segment provides engineered precision metal components using processes consisting of metal injection molding; tooling products; and plastic injection molding products. You can think of Arc Group as more of a mass production, industrial 3D printing company. Whereas other companies in this list sell the printers themselves.

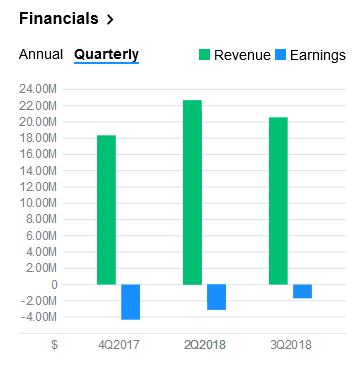

The company is undergoing a shift into aerospace and medical. These industries provide better predictability and margins and will continue to open up a much larger total available market. Their reasoning is that the current defense and communications products will not provide the needed growth opportunities.

The company has been absolutely crushed over the past 5 years. The company continues to post losses every quarter. The company also has a large debt load. On the positive side, on a quarterly basis, the losses are trending back up towards positive territory.

It remains to be seen if the pivot will improve the outlook on the stock.