The expansion of CCIP into general access marks a pivotal moment in Defi history. What it could mean for the future:

Expansion of DeFi and Unforeseen Innovations

CCIP facilitates asset movement from one chain to another, further enabling the space for liquidity in the DeFi and movement of assets between the different blockchains to give way for great deep markets in DeFi. Now, since the walls are coming down between these networks, smaller blockchains will be able to take advantage of the liquidity of bigger ones, like Ethereum, and unleash a much more innovative array of financial services and products. This will also be poised to drive financial inclusion on the back of easier access to financial services for an otherwise underserved population.

Competition for liquidity may decrease, yet new types of interchain competition could emerge that are not easily predicted. Perhaps some that represent more cultural and technical differences. On the flip side, as the zero-sum skirmish for liquidity is reduced, CCIP could have a galvanizing effect to the ecosystem as whole. This space together sets their sights in unison on the broader financial system.

Enhanced Security and Trust with Cross-Chain Transactions

This has always been one of the biggest weaknesses in history in cross-chain operations: the high vulnerability to security risks. This is the most important problem for the majority of the investors and for the development of the industry. Thus, high security for CCIP is ensured through a limit in these risks, implemented by means of Programmable Token Transfers and the Transporter application. As trust in cross-chain transactions will strengthen, it is possible to expect wider acceptance and use from individual users to institutional players of this technology.

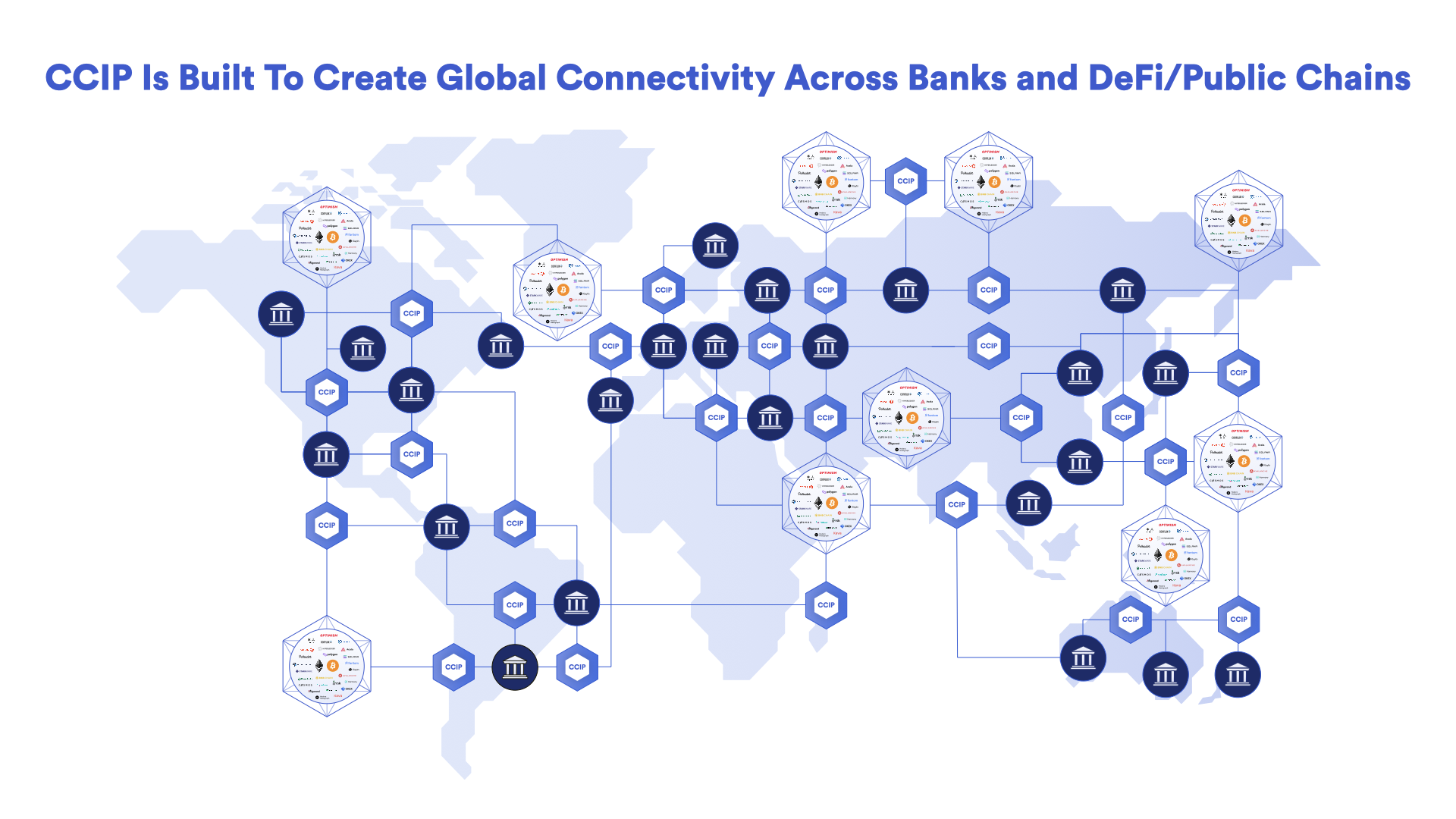

Acceleration of Traditional Finance Integration with DeFi

The RWA tokenization capability of CCIP has the attraction for traditional financial institutions looking for an entry point in blockchain technologies with secure, compliant environments. The fact that it has a way to maintain the continuous upkeeping of asset information across chains may encourage more institutions to tokenize their assets. This would effectively serve as a bridge between traditional finance (TradFi) and DeFi. Likely to culminate in the “Internet of Contracts,” whereby digital and conventional financial services get perfectly integrated with each other to offer a unified global financial ecosystem.

In the end, banking’s core competence is financial engineering and customer service, with software being a secondary competence. Offloading certain products to decentralized systems to save money could be too enticing to pass up, just as many companies offshore employees today. Blockchain may be a useful A.I. adoption hedge, as security and alignment flaws slip by their creators, or simply move too fast to intercept. On the guardrails of a wider security network, with all eyes on each other, these problems could be mitigated.

Growth in the Tokenized Assets Market

General availability of CCIP, coupled with Chainlink data feeds and Proof of Reserve, should go a long way in making the tokenization of asset process easy for creators and managers of tokenized asset positions. This would most probably expand the market for tokenized assets from just cryptocurrencies to other classes, such as real estate, stocks, and bonds. This will be in a position to ensure improvement in the efficiency of the markets and verifiability of the assets, a concomitant necessity to provide confidence to the investors and regulatory compliance by availing consistent and verifiable data across the blockchains.

Innovation in Smart Contract Development

CCIP allows devs to create even more high-end and responsive smart contracts that would be able to interact with other blockchains. This feature would, therefore, be the gateway to creating a new kind of decentralized application (dApp) that was hitherto not possible in a single-chain environment. Now a new generation smart contract can take advantage of assets, triggers, and information from different blockchains in such a way that they boost utilities and effectiveness.

Increased Blockchain Adoption Across Sectors

The main aim of CCIP is to make the complex cross-chain interactions bearably cheap so that their technology becomes available and quite practical for different applications in industries such as gaming, health, supply chain, among others. This could, in turn, spur widespread adoption, as businesses continue to look for ways to leverage blockchain for its transparent, secure, and efficient features. Future Developments and Technological Enhancements CCIP should be designed to evolve and support more blockchains and tokens in the future so as to ensure that it remains flexible and is, therefore, a versatile way of developing blockchain-based applications. Future human capital development will likely center on the scaling of this infrastructure, handling ever-higher volumes of more complex types of data and transactions to further solidify the foundation role it will play in the future of interconnected blockchain networks.

Conclusion

With the general availability of the Chainlink CCIP, it will represent the beginning of a more connected and fortified blockchain ecosystem, one that bears the potential to impact enormously the future interplay between DeFi and the traditional financial system landscape. As the protocol evolves, its influence is likely to be profound, shaping the ways in which funds are transferred, administered, and perceived across digital and physical worlds.

Leave a Reply