History often offers valuable lessons for the present. A comparison between November 1967 and August 2024 reveals fascinating parallels in currency dynamics, commodities markets, and global economic trends. These two moments in time, separated by nearly six decades, exhibit striking similarities in how economies grapple with inflation, currency weakness, and the global commodity landscape.

Let’s dive into the similarities across key economic dimensions—currencies, gold, commodities, and global power shifts—to better understand the forces shaping both eras. Incredibly, technology development of the late 60’s also seem to rhyme with advancements today.

1. Currency Staples: The British Pound (1967) vs. The Japanese Yen (2024)

In both 1967 and 2024, currency depreciation played a pivotal role in defining the economic climate.

The British pound played a much bigger role in the late 60’s.

The JPY today has emerged to play a similar role as a benchmark for risk-off trades and general influence on global economics.

1967: British Pound Devaluation

On November 18, 1967, the British government made a dramatic move, devaluing the British pound by 14.3%, reducing its value from $2.80 to $2.40. The devaluation aimed to combat Britain’s widening trade deficit, chronic inflation, and declining gold reserves. While it was intended to make British exports more competitive, it also sparked inflation and underscored the UK’s structural economic weaknesses.

2024: Japanese Yen Decline

Fast forward to 2024, and we witness a similar pattern in Japan. Over the past several years, the Japanese yen has weakened significantly, reaching its lowest point against the U.S. dollar in decades. Unlike the pound’s formal devaluation in 1967, the yen’s depreciation stems from the Bank of Japan’s loose monetary policy, in contrast to the tightening cycle of other major central banks. Like Britain in 1967, Japan has been grappling with weak growth, trade deficits, and inflationary pressures, prompting concerns about the broader health of the economy.

Parallel: Both episodes reflect the consequences of currency weakness due to trade imbalances, slow economic growth, and inflation. In 1967, Britain made a bold choice to formally devalue its currency, while in 2024, Japan’s yen decline reflects the market outcome of economic stress and Central Bank Operations. In both cases, these currency moves triggered ripple effects across global financial markets.

2. Technology

Technological advancements have profoundly influenced global security and economic dynamics in both periods.

1967: Technological Progress and Global Tensions

- The late 1960s saw rapid advancements in computing technology, including the space race and the development of nuclear weapons. These innovations not only showcased the technological prowess of nations but also raised global security concerns as the arms race between superpowers intensified.

2024: Emerging Technologies and Security Challenges

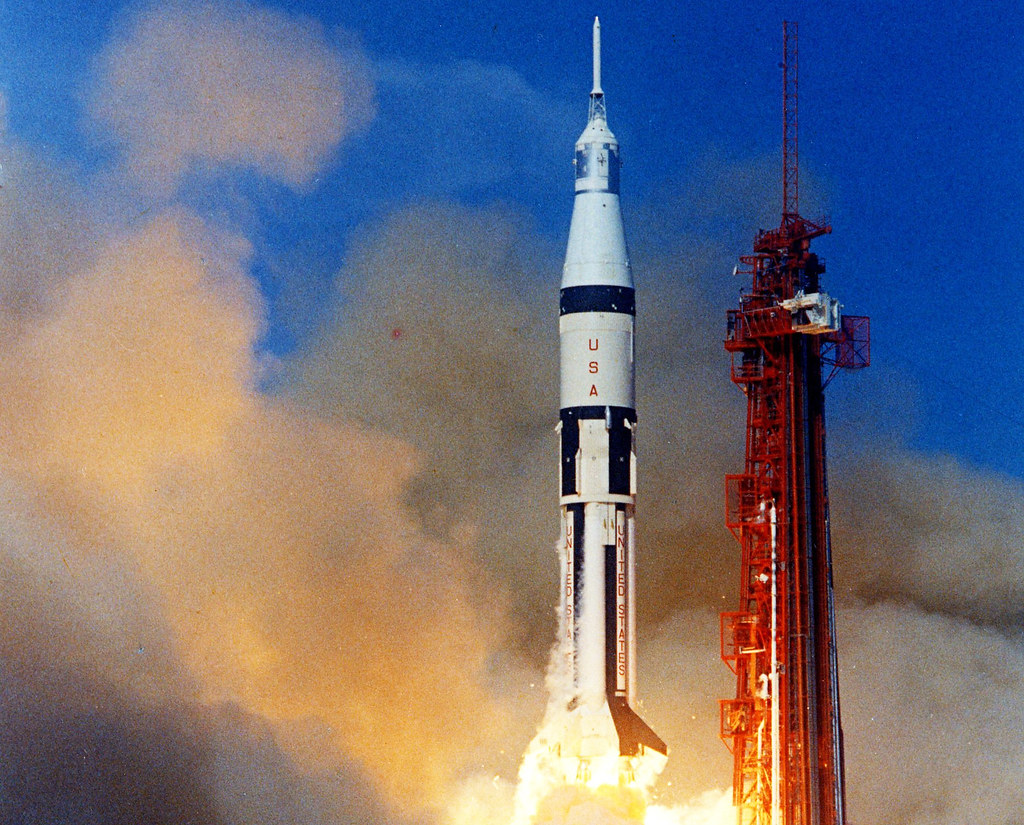

- In 2024, emerging technologies such as artificial intelligence (AI), cyber warfare, and biotech pose new challenges to global security. Reusable rockets pioneered by Space X have revitalized the aerospace industry after a long malaise. The Space Force yet another uncanny echo of the hay-day of NASA. The rapid development of these technologies raises concerns about their potential misuse, ethical implications, and the need for updated security protocols to address new forms of threats.

Parallel: Technological advancements in both periods drive significant changes in global security dynamics. While the specific technologies and their applications have evolved, the fundamental impact of technological progress on security and geopolitical stability remains a constant theme. Space race vs Space Race 2.0 AI race, Man on Moon vs Man on Mars, Birth of the Internet(ARPANET) vs Birth of the LLM(CHAT-GPT)

3. Geopolitics: Shifting Global Dynamics

The geopolitical landscape in both 1967 and 2024 reflects significant shifts in global power and influence.

1967: Cold War and Middle Eastern Tensions

- Rise of New Powers: In 1967, the Cold War between the US and the Soviet Union dominated global geopolitics. During this period, China was emerging as a major power, impacting regional dynamics in Asia.

- Middle Eastern Tensions: The Six-Day War of 1967 dramatically altered the political landscape in the Middle East. The Israeli-Palestinian conflict remained unresolved, and the region continued to be a hotbed of tension with ongoing conflicts and instability.

2024: Modern Geopolitical Challenges

- Rise of New Powers: By 2024, China’s rise is far more pronounced, with its growing economic and military influence posing a significant challenge to the US-led global order. The dynamics of global power are increasingly centered on the competition between the US and China, with other emerging economies also playing a crucial role.

- Middle Eastern Tensions: The Middle East remains a region of high volatility, with ongoing conflicts in Syria and Yemen, and enduring concerns over Iran’s nuclear ambitions. The unresolved Israeli-Palestinian conflict continues to be a major source of regional instability.

Parallel: In both 1967 and 2024, geopolitical tensions and the rise of new powers significantly influence global stability and economic conditions. While the specific actors and conflicts may have changed, the underlying dynamics of shifting power and regional instability remain a constant factor in global geopolitics.

4. Gold: A Safe Haven in Times of Instability

Throughout history, gold has played an enduring role as a safe-haven asset during times of economic uncertainty, inflation, and currency instability.

1967: Gold in the Bretton Woods Era

In 1967, gold was still officially tied to the U.S. dollar through the Bretton Woods system at a fixed price of $35 per ounce. However, growing economic strains—exemplified by the pound’s devaluation—caused rising demand for gold. Investors were starting to question the sustainability of the fixed exchange rate system, leading to heightened interest in gold as a hedge against the mounting risks of currency devaluations. This demand contributed to the eventual collapse of the Bretton Woods system in 1971.

In 1971 (the so-called “Nixon Shock”), the Bretton Woods system effectively ended. Without the dollar-gold peg, gold was allowed to float freely in global markets, unleashing the pent-up demand that had been building for years.

2024: Gold’s Resilience in Modern Markets

By 2024, gold operates in a floating exchange system, free from any official monetary role, yet it remains a key asset for central banks and investors alike. In response to inflationary pressures, the ongoing war in Ukraine, and geopolitical uncertainty, gold prices have risen steadily. Like in 1967, investors see gold as a store of value amidst currency instability (such as the yen’s decline) and rising inflation across the globe.

Parallel: In both 1967 and 2024, gold serves as a hedge against currency devaluation, inflation, and economic uncertainty. The British pound’s devaluation in 1967 and the yen’s depreciation in 2024 both highlight gold’s role as a safeguard against systemic financial risks.

Unlike 1967, gold has made significant gains, but I argue that’s only because it was artificially supressed due to the Bretton Woods system. So this time around the move upward in gold might be more gradual, though still eventually arriving at the same destination.

5. Commodities

Beyond gold, other commodities like copper, silver, and agricultural products also tell a powerful story about global economic growth and volatility in both eras. See: how The Digital Dollar is the New Petrodollar, Because Data is The New Oil – Enclave (enclaveresearch.com)

1967: Industrial Commodities and Post-War Growth, Oil

In the late 1960s, industrial commodities like copper and steel were critical to post-war reconstruction and growth. As global infrastructure projects surged, so did demand for metals. However, by 1967, inflationary pressures and currency weakness began to affect commodity prices, highlighting cracks in the post-war economic boom. Commodities like silver were also gaining prominence due to rising industrial demand and its role as a secondary store of value.

During 1967, oil was in decline, a prelude to the early 70’s massive reversal in prices.

2024: Commodities in the Age of Green Transition, Oil

Parallel: Commodities act as a barometer for economic growth in both periods. In 1967, industrial commodities reflected post-war reconstruction efforts, while in 2024, they represent the global transition to green energy. In both eras, economic uncertainty and inflationary pressures caused increases in commodity prices.

Both eras experienced stagnation of oil prices, characterized by a long sideways trading range before a sudden breakout to a new plateau. Could we see a breakout in the coming years, a repeat of 1973, as possibly the next major wave of inflation. In other words, could be the prelude to a new price range floor at around 200/barrel.

6. Interest Rate Shifts

1967–1968: Rising Yields Amid Inflation Concerns

- As inflation began creeping upward, bondholders demanded higher yields to compensate for eroding purchasing power. Central banks, wary of overheating, started tightening monetary policy.

2020s: Volatility in Government and Corporate Debt

- Current inflation and fears of more rate hikes have led to bond market volatility. Investors are increasingly sensitive to central bank signals, demanding higher yields on both government and corporate bonds when inflation expectations rise.

Parallel: Both eras feature rising yields as markets adjust to inflation risks. Central banks face the familiar dilemma: tighten too fast and risk recession, or move too slowly and risk embedding higher inflation.

Conclusion: Lessons from the Past for the Present

While 1967 and 2024 are separated by decades, the parallels are striking. From currency devaluations to commodity price volatility, the economic challenges of these two periods share common roots in inflation, trade imbalances, and global shifts in economic power. By examining these historical similarities, we can gain deeper insights into the forces shaping today’s global economy—and perhaps glimpse what lies ahead.

As history has shown, economies are cyclical, and the patterns of the past often offer valuable lessons for navigating the uncertainties of the present.

Leave a Reply