How long the U.S. can sustain it’s ballooning Federal Debt? Considering fiscally-minded people have been calling for a debt-fueled economic collapse since the 80’s, it’s worth pondering the exact opposite scenario: That governments can hold out for many more decades with central banks ready to back-stop the system. Here we question common assumptions associated with the U.S. debt levels, without denying that it’s indeed a serious problem. As experienced traders will say “don’t tell me what to buy, tell me when to buy it”. The same applies here. Timing is important.

Another important point is how the debt unwind will occur. The doomsayers claim it will be a violent and abrupt awakening. Though in the modern, global economy we have numerous financial tools and assets at our disposal that can be easily shifted. What if the great sovereign debt unwind ends not with a bang, but a whimper? A slow and orderly evacuation to the many life boats available, instead of an every man for himself scramble off the Titanic.

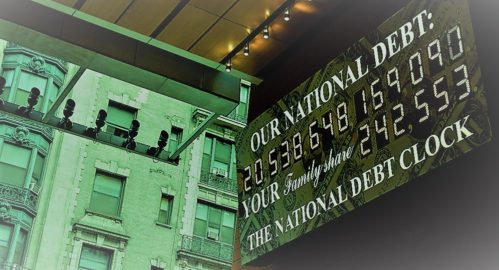

Public Debt

Below is the total federal debt as a percentage of GDP multiplied times the 10 year treasury interest rate. It essentially measures how sustainable our interest payments are, rather than the debt as a whole. Since interest rates remain so low, we still are able to keep borrowing enormous amounts without a hitch. In fact, we’re nowhere near its peak.

Astute critics will point out that as soon as interest rates rise, the debt problem will quickly escalate. Although the Japanese Central bank has been able to sustain low interest rates for decades. It stands to reason that the FED can do the same, especially since the Fed funds rate still has some wiggle room relative to Japan’s equivalent.

Private Debt

Alarmists will also point to corporate and consumer debt as a cause for imminent recession. Which in turn will affect the governments ability to fund deficits. However, we’re in a much different situation than we were in 2008. Corporate debt remains low as a percentage of market cap.

Consumer debt, while not at lows, is within the normal range.

Financial Life Boats

Since there are many safe havens today such as Bitcoin and Gold. They can serve as release valves that people can hop to when need be. Unlike in the many inflationary panics of the past, these release valves were difficult to access for everyday people, or didn’t exist at all. It’s possible that over time, a slow unwind can take place with these assets.

Conclusion

Although the high debt burden is certainly not without its consequences, the disastrous view on how it will play out should be questioned. We should put it in context of today’s technology and central banking dominance.

Leave a Reply