RSI Code

Pine Script version 5 strategy for TradingView with relative strength index (RSI) trading strategy is given in the first code. It is a chart overlay to help traders interpret market data and make better trade judgments by giving signals for entering a long position using RSI.

//@version=5

strategy("Normal RSI Strategy", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=2)

// Inputs for strategy parameters

rsiLength = input.int(14, title="RSI Length")

rsiOverbought = input.int(70, title="RSI Overbought Level", minval=50, maxval=100)

rsiOversold = input.int(30, title="RSI Oversold Level", minval=0, maxval=50)

// Calculate the RSI

rsiVal = ta.rsi(close, rsiLength)

// Define the entry and exit conditions

enterLong = ta.crossover(rsiVal, rsiOversold)

exitLong = ta.crossunder(rsiVal, rsiOverbought)

// Execute the strategy

if (enterLong)

strategy.entry("Buy", strategy.long)

if (exitLong)

strategy.close("Buy")

// Plot RSI on the chart for visual reference

plot(rsiVal, "RSI", color=color.blue)

hline(rsiOverbought, "Overbought", color=color.red)

hline(rsiOversold, "Oversold", color=color.green)

// Plotting entry and exit points for clarity

bgcolor(enterLong ? color.new(color.green, 90) : na)

bgcolor(exitLong ? color.new(color.red, 90) : na)

RSI + Martingale Code

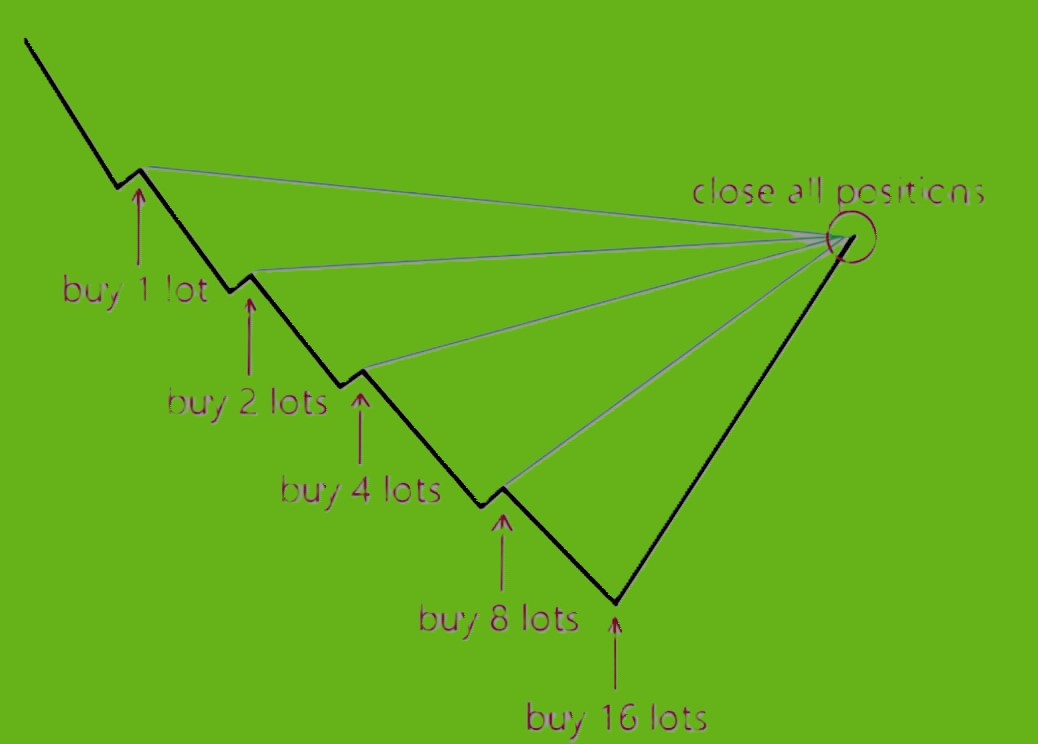

Now this code outlines a Martingale-enhanced RSI (Relative Strength Index) trading strategy using Pine Script v5. This strategy is designed for the TradingView platform, employing a Martingale betting system to adjust position sizes based on previous trade outcomes.

Martingale Position Sizing:

- The code implements a Martingale strategy for position sizing, where the position size is doubled after each loss until a winning trade occurs or the maximum number of consecutive losses is reached.

qtyToTrade: Variable to store the quantity of the asset to trade.consecutiveLosses: Tracks the number of consecutive losing trades.lastTradeProfit: A boolean flag indicating if the last trade was profitable.

//@version=5

strategy("Martingale Enhanced RSI Strategy", overlay=true)

// Define the parameters

rsiSource = close

rsiLength = 14

riskPerTrade = 0.02

accountBalance = 1000000

rsiOverbought = 70

rsiOversold = 30

maxConsecutiveLosses = 4

// Calculate the RSI

rsiVal = ta.rsi(rsiSource, rsiLength)

// Define the entry and exit conditions

enterLong = ta.crossover(rsiVal, rsiOversold)

exitLong = ta.crossunder(rsiVal, rsiOverbought)

// Martingale position sizing

var float qtyToTrade = 0

var int consecutiveLosses = 0

var bool lastTradeProfit = true

if (enterLong)

if (lastTradeProfit)

qtyToTrade := math.floor(accountBalance * riskPerTrade / (high - low))

consecutiveLosses := 0

else

if (consecutiveLosses < maxConsecutiveLosses)

qtyToTrade := qtyToTrade * 2 // Double the position size after each loss

else

qtyToTrade := math.floor(accountBalance * riskPerTrade)

consecutiveLosses := consecutiveLosses + 1

strategy.entry("Buy", strategy.long, qty=qtyToTrade)

if (exitLong)

strategy.close("Buy")

lastTradeProfit := false

// Reset position sizing after a winning trade

if (strategy.closedtrades > 0)

lastTradeProfit := true

consecutiveLosses := 0

qtyToTrade := math.floor(accountBalance * riskPerTrade)

// Plot RSI on the chart

plot(rsiVal, "RSI", color=color.blue)

hline(rsiOverbought, "Overbought", color=color.red)

hline(rsiOversold, "Oversold", color=color.green)

Bollinger Bands + Martingale

Next up we’ll take a bollinger band strategy and apply martingale position sizing.

Martingale Position Sizing Logic

- A variable to track the percentage of equity risked (

martingaleRisk) is adjusted daily. If the trade loses, the risk percentage for the next trade is doubled, adhering to the Martingale principle. - The risk is capped at 50% to prevent excessive exposure, a critical safeguard to mitigate the risk of significant drawdowns.

//@version=5

strategy("Bollinger Bands Martingale Strategy - Corrected", overlay=true, initial_capital=100000)

// Inputs for strategy parameters

length = input.int(20, title="Length")

mult = input.float(2.0, title="Multiplier")

initialRisk = input.float(2, title="Initial Risk Percentage", minval=0.1, maxval=10)

// Bollinger Bands calculation

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper = basis + dev

lower = basis - dev

// Plot Bollinger Bands

plot(basis, "Basis", color=color.blue)

plot(upper, "Upper Band", color=color.red)

plot(lower, "Lower Band", color=color.green)

// Martingale position sizing variables

var float martingaleRisk = initialRisk

var int lastTradeDay = na

// Reset martingaleRisk at the beginning of each day

if (dayofmonth != lastTradeDay)

martingaleRisk := initialRisk

lastTradeDay := dayofmonth

// Entry conditions

enterLong = ta.crossover(close, lower)

enterShort = ta.crossunder(close, upper)

// Exit conditions

exitLong = ta.crossover(close, basis)

exitShort = ta.crossunder(close, basis)

// Strategy execution with martingale position sizing logic

if (enterLong)

strategy.entry("Long", strategy.long, qty=strategy.equity * martingaleRisk / 100 / close)

martingaleRisk := martingaleRisk * 2 // Increase risk for next trade

if (enterShort)

strategy.entry("Short", strategy.short, qty=strategy.equity * martingaleRisk / 100 / close)

martingaleRisk := martingaleRisk * 2 // Increase risk for next trade

if (exitLong)

strategy.close("Long")

if (exitShort)

strategy.close("Short")

// Cap the martingaleRisk to prevent excessive exposure

martingaleRisk := math.min(martingaleRisk, 50)

Leave a Reply