Introduction

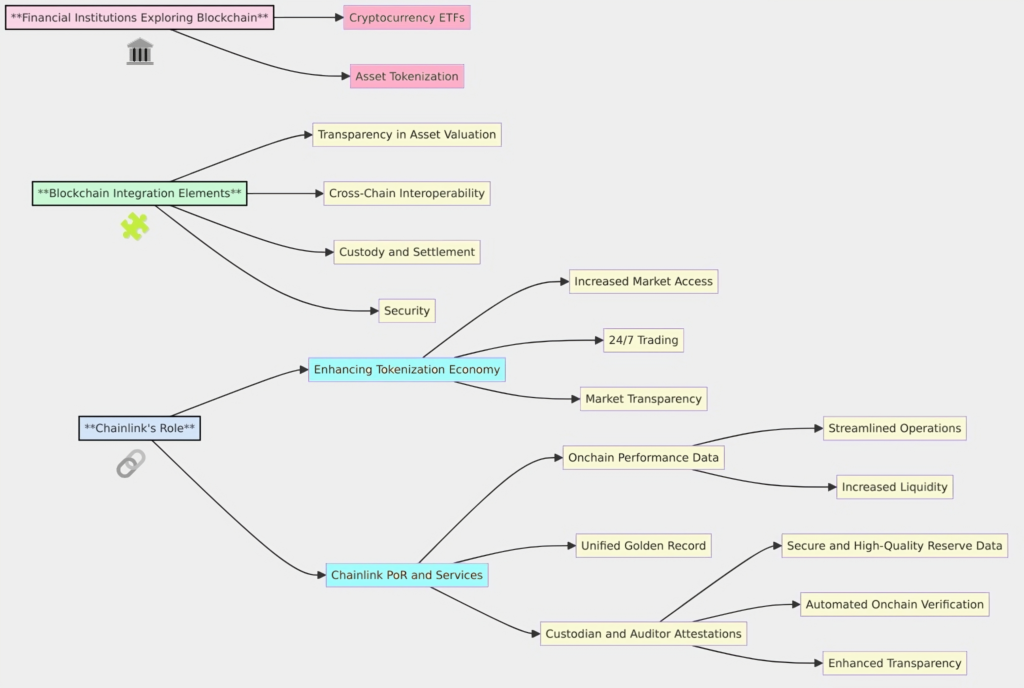

This summary of the blog post focuses on how institutions will integrate with the blockchain ecosystem now and in the future. Key elements for integration include transparency, cross-chain interoperability, custody, settlement, and security. You can read the full article here.

🏛️ Financial Institutions Exploring Blockchain: This includes initiatives such as cryptocurrency ETFs and asset tokenization.

🧩 Blockchain Integration Elements: Necessary elements for integration include:

- Transparency in asset valuation

- Cross-chain interoperability

- Custody and settlement

- Security

🔗 Chainlink’s Role: Chainlink aims to enhance the tokenization economy through its services like Proof of Reserve (PoR) and Daily Reference Price.

🌐 Enhancing Tokenization Economy:

- Increased Market Access: Asset tokenization allows for easier buying, selling, and trading of digital tokens, enabling fractional ownership.

- 24/7 Trading: Tokenization leverages blockchains that operate continuously, allowing for trading at any time.

- Market Transparency: Tokenization records all transactions on an immutable blockchain ledger, enhancing market transparency.

🔍 Chainlink PoR and Services: Chainlink provides essential infrastructure for the tokenization economy by verifying the status of offchain assets and relaying that information onchain. This helps create a unified golden record that enhances utility and transparency.

Other Noteworthy Concepts in this Blog Post

Proof of Reserve

🌟 Enables custodians and auditors to provide secure and high-quality reserve data, automated onchain verification, and enhanced transparency.

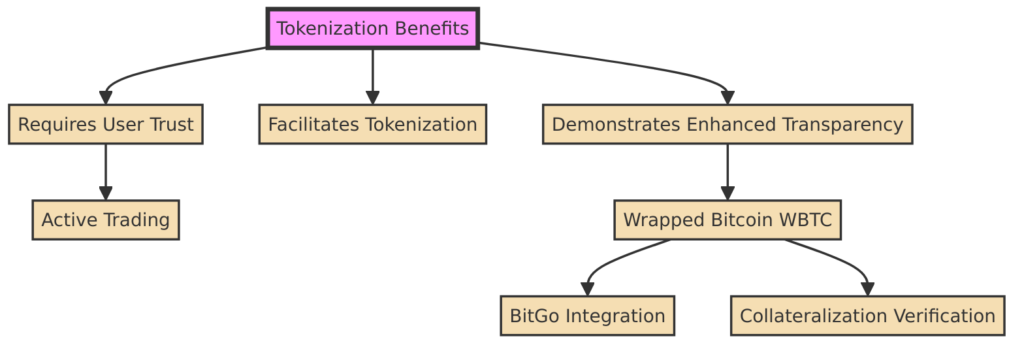

Tokenization Benefits

🌟 Facilitated by Chainlink Proof of Reserve include: Demonstrating enhanced transparency through Wrapped Bitcoin (WBTC) and its integration with BitGo for collateralization verification.

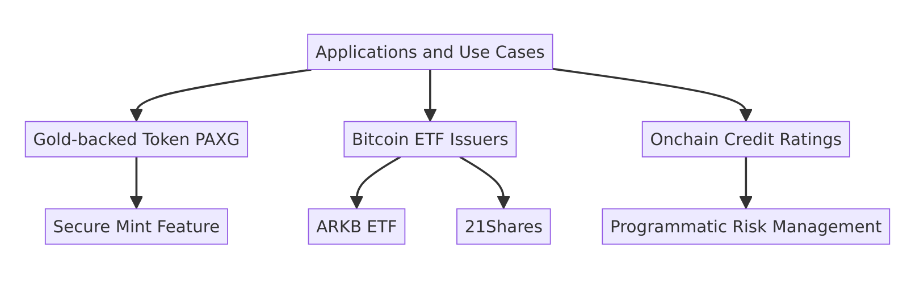

Applications and Use Cases

🌟 Include Gold-backed Tokens (PAXG) with secure mint features, Bitcoin ETF issuers like ARKB ETF and 21Shares, and Onchain Credit Ratings for programmatic risk management.

Leave a Reply