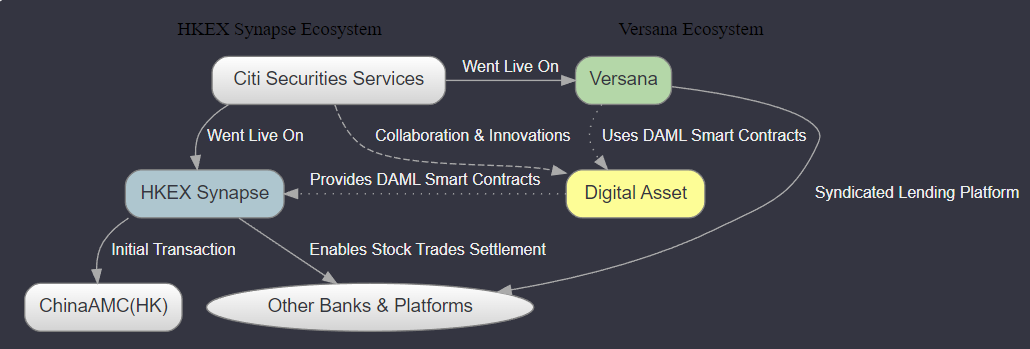

To further enhance the effectiveness and protection of financial transactions in different areas, Citi Securities Services recently started to operate on two major smart contract platforms which could have a positive impact on the industry in terms of efficiency.

HKEX Synapse: One of the platforms where Citi has linked its services with is HKEX Synapse which is a smart contract platform that was created to improve post-trade processes for Northbound Connect, the Hong Kong Exchanges and Clearing (HKEX) system that allows Hong Kong and international investors to settle stock trades on Shanghai Stock Exchange. This system is notable for a number of reasons such as it enables stock settlements to be done faster through allowing collaborative sharing of data across multiple intermediaries instead of sequential processing. Citi has been among the first banks to take part in Synapse pilots since 2019, while being ranked as fourth global custodian by assets under custody ($27.8tn), and now has become the only bank introducing its full custody solution into Synapse. The first-ever transaction occurred between ChinaAMC (HK) as Citi’s counterparty on Synapse, demonstrating how this platform could facilitate funds flow from Hong Kong into mainland China.

Versana Syndicated Lending: Citi also went live on Versana, which is a smart contract solution for the syndicated lending market with an aim of digitizing and streamlining the process of syndication. The value of loans processed through Versana, co-founded by major financial institutions including Citi, has recently exceeded $900 billion. The platform’s emphasis on instantaneous exchange of information holds the key to expanding the syndicated loan market. In proof that Versana has been moving forward strongly, it’s about to undertake its first round of funding worth $40 mln and prepare to accept other major syndicated loan agents into its system.

Both platforms, HKEX Synapse and Versana, are built on Digital Asset’s DAML smart contracts technology reinforcing Citi’s innovative blockchain-driven approach towards enhancing transaction efficiency in finance. This action is part of a broader move where Citi has been actively involved in several blockchain initiatives such as Regulated Liability Network (RLN) trials for interbank payments in the US and launching Citi Token Services to assist money movements worldwide through tokenization across branches.

Leave a Reply