Category: Smart Contracts

-

Hex Early Unstake Penalty Calculator

Staked HEX Amount: Stake Start Date: Add Days from Start: Original End Date: Emergency End-Stake Date: Interest Received (HEX): This is the estimated total interest you’d earn if you held to the end. Calculate

-

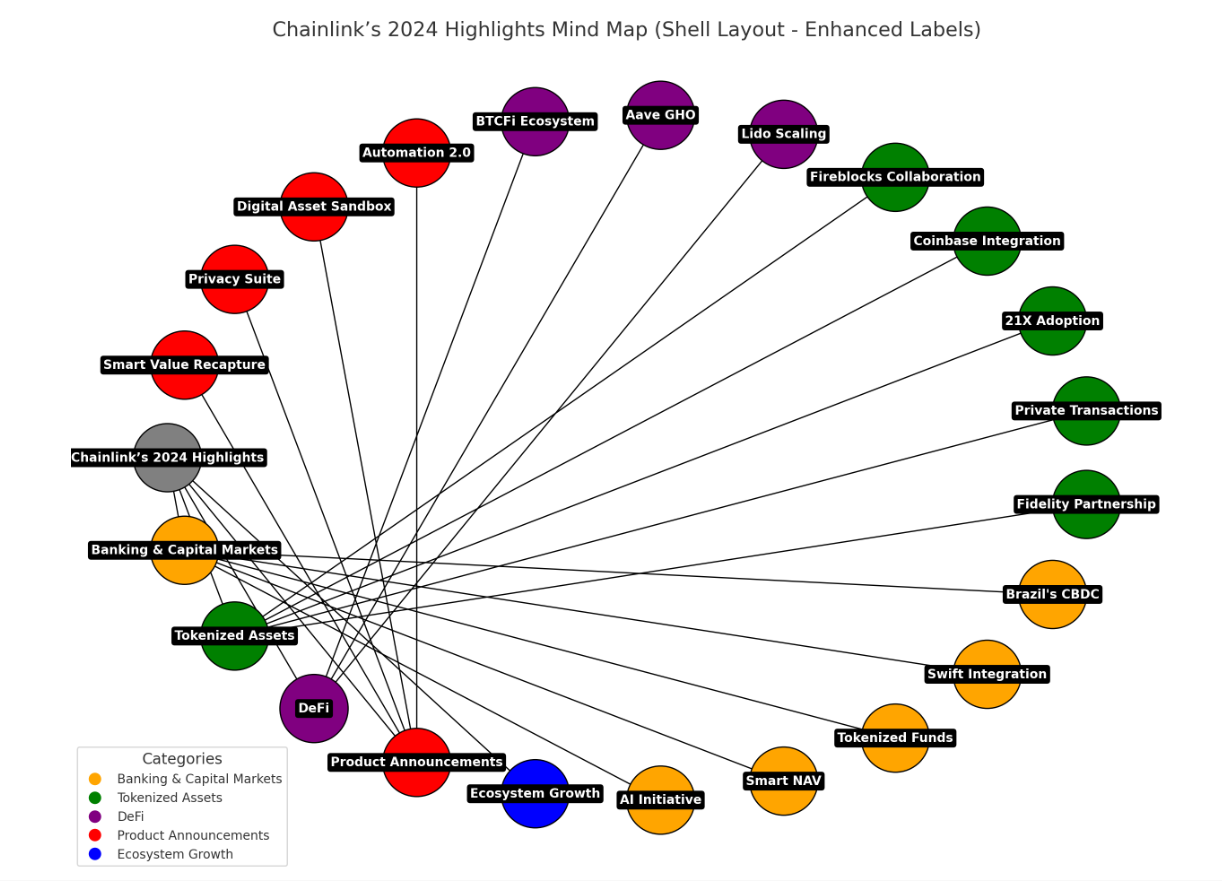

Chainlink Year In Review Shell Diagram

Capital Markets Tokenized Assets Defi Product Announcements Breakdown Banking & Capital Markets: Highlights initiatives like AI integrations, Smart NAV, tokenized funds, Swift integrations, and Brazil’s CBDC. Tokenized Assets: Focuses on partnerships with Fidelity, private transactions, 21X adoption, Coinbase integration, and Fireblocks collaboration. DeFi: Explores scaling initiatives with Lido, Aave’s GHO stablecoin, and the BTCFi ecosystem.…

-

Overcoming LLM Hallucinations in Financial Services: Chainlink Blog Post Summary

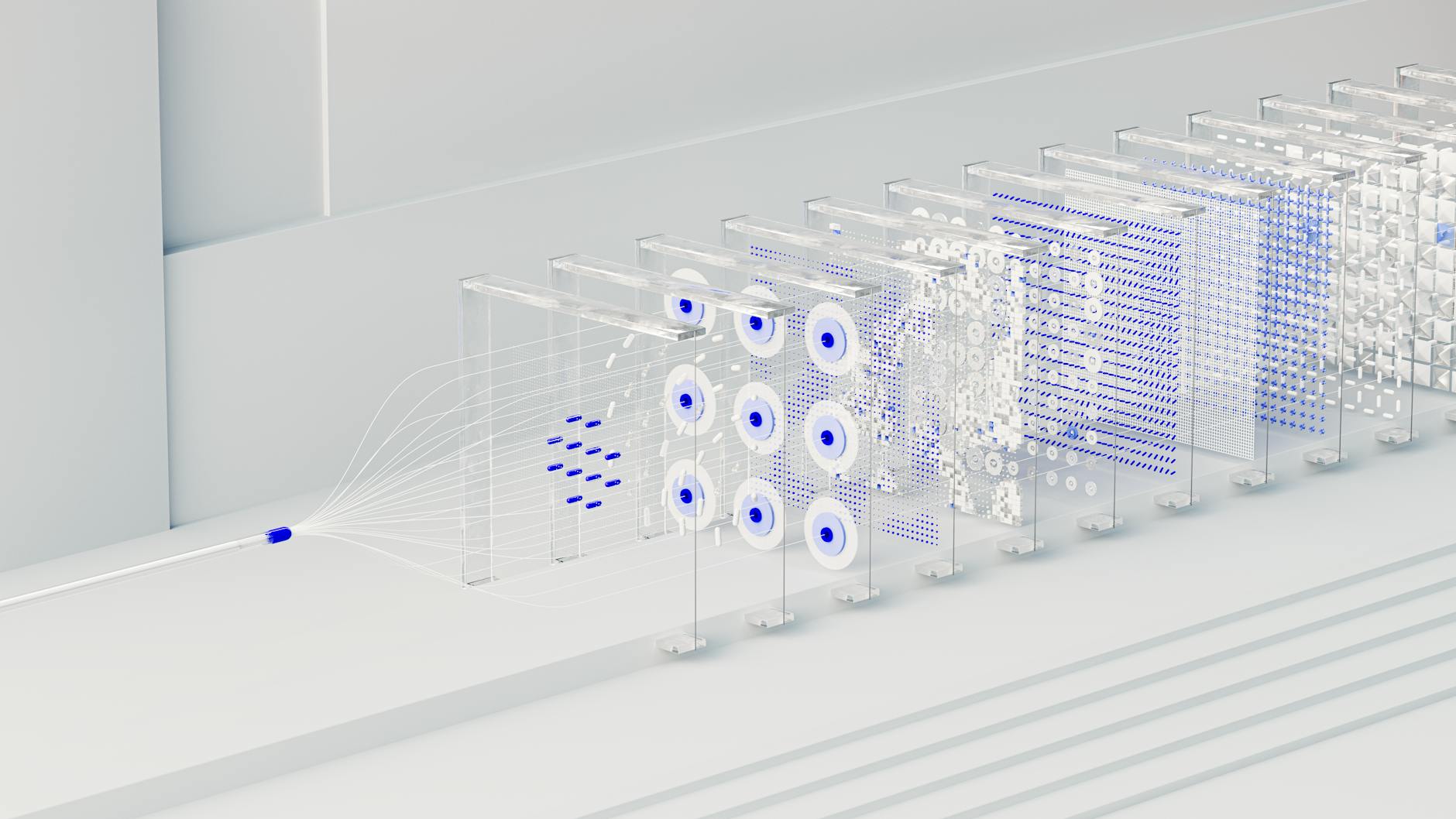

The full blog post can be read here. Understanding Hallucinations in LLMs This diagram will explain how hallucinations occur in LLMs. It uses a flowchart style to visualize the step-by-step token prediction process leading to hallucinations. LLM Consensus Framework This diagram visualizes how multiple LLMs collaborate in a consensus process to validate outputs and mitigate…

-

Chainlink Runtime Environment – Mind Maps Summary

Mind maps from the Chainlink Runtime Environment announcement blog post. The full blog can be read here. Overview of the Chainlink Runtime Environment (CRE) Benefits of the Upgraded Chainlink Platform Evolution Toward a Modular Developer Platform Chainlink Platform Relationships DON Interaction in Chainlink Runtime Environment

-

Chainlink Project Guardian Mind Map Summary

You can read the full blog post here. (Right click and open to see full image in new tab.)

-

Numerai Makes Crypto Meta Model Public

Numerai has made it’s crypto predictions public here for traders to use. Interpreting the Numerai data involves understanding several key components related to model performance, correlations, and historical data. Here’s a breakdown of what this information tells us about potential trading strategies: Model Performance Current Model Correlations Historical Data Interpretation The historical data provided includes…

-

Essential Cross-Chain Security Considerations: Concept Map

Overview Here is an overview of the article. Overall, security is a key tenet. Next, there are certain best practices that are essential. Vendor Lock-in Vendor lock-in, also known as proprietary lock-in or customer lock-in, makes a customer dependent on a vendor for products, unable to use another vendor without substantial switching costs. In terms of tradfi adoption, vendor lock-in and the…

-

-

Adapting Chainlink’s Watchdog System for AI Safety: A Novel Approach

Artificial intelligence is rapidly developing with great potential, though comes with significant risks. As we work hard to ensure that AI systems can remain safe and aligned with human values, new approaches from other domains could provide us with inspiration. One such promising approach is the staking and watchdog system developed by Chainlink, currently used…

-

Chainlink Product Update: Q2 2024 Infographics

Chainlink has covered alot of ground in the first half of Q2, and it’s only getting started. Here’s an overview of developments you might have missed. Banking and Capital Markets Solutions Cross Chain Compute Honorable Mention: Chainlink Platform Chainlink has also been revamping its core code to the Chainlink platform, with the goal of meeting…

-

Infographic: Introducing the Chainlink Digital Assets Sandbox

The following infographics are from the Chainlink blog post on their new turnkey solution for financial institutions. Overview of Digital Asset Journey The Tokenized Asset Opportunity The Chainlink Digital Assets Sandbox

-

Concept Maps: Chainlink Digital Asset Insights: Q2 2024

Introduction This summary of the blog post focuses on how institutions will integrate with the blockchain ecosystem now and in the future. Key elements for integration include transparency, cross-chain interoperability, custody, settlement, and security. You can read the full article here. 🏛️ Financial Institutions Exploring Blockchain: This includes initiatives such as cryptocurrency ETFs and asset…

-

Chainlink Concept Map: Unified Golden Records for Tokenized Assets

Tokenization of RWAs: The process of representing real-world assets as digital tokens on blockchains and its potential to revolutionize asset management. Current Challenges with Tokenization: Issues such as fragmentation across blockchains and the need for consistent on-chain data. Unified Golden Records: A solution that provides a verifiable, updateable, and synchronized data container for tokenized assets,…

-

Concept Map: 3 Key Architectural Decisions Behind CCIP’s Advanced Security

Chainlink’s Cross Chain Interoperability Protocol has 3 key Architectural tenants regarding security.Below is a concept map of chainlink’s blog post on CCIP Architecture.

-

Beyond Token Issuance: Chainlink Infographic

Explanation of the Mind Map: Definitive Guide to Tokenized Assets This mind map summarizes the key concepts from the “Definitive Guide to Tokenized Assets.” It is organized into several main sections: This visualization helps in understanding the comprehensive insights provided in the report, facilitating easier navigation and comprehension of the complex topic of tokenized assets.

-

Smart Contracts Arrive On Stellar Ecosystem

Stellar Starts Smart Contract Rollout for ‘Soroban’ in Phases. Implementation of the “Protocol 20” upgrade on the Stellar blockchain has begun, signaling the start of a phased release aimed at bringing Ethereum-like smart contracts into the platform’s payment-focused framework as part of an ongoing initiative called Soroban. “The Stellar smart contracts tech stack is in…

-

New VC Law To Accelerate web3 Growth in Japan

Cabinet Approval for New Crypto Investment Structures On Friday, Japan’s Cabinet approved legislation called the Industrial Competitiveness Enhancement Act. This is to be enacted through an inclusion in the bill of a provision that would permit limited liability partnerships (LLPs), a structure commonly used by venture capital (VC) firms, to invest in crypto assets. Evolving…

-

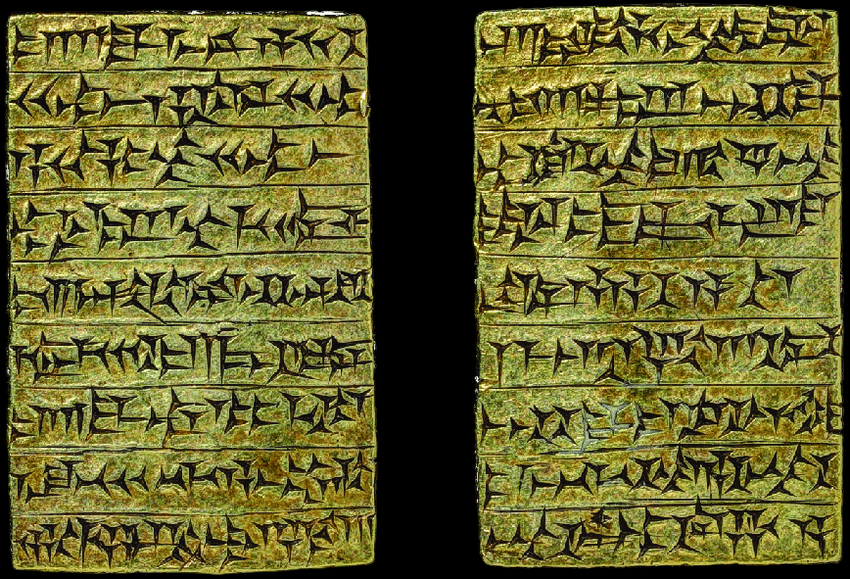

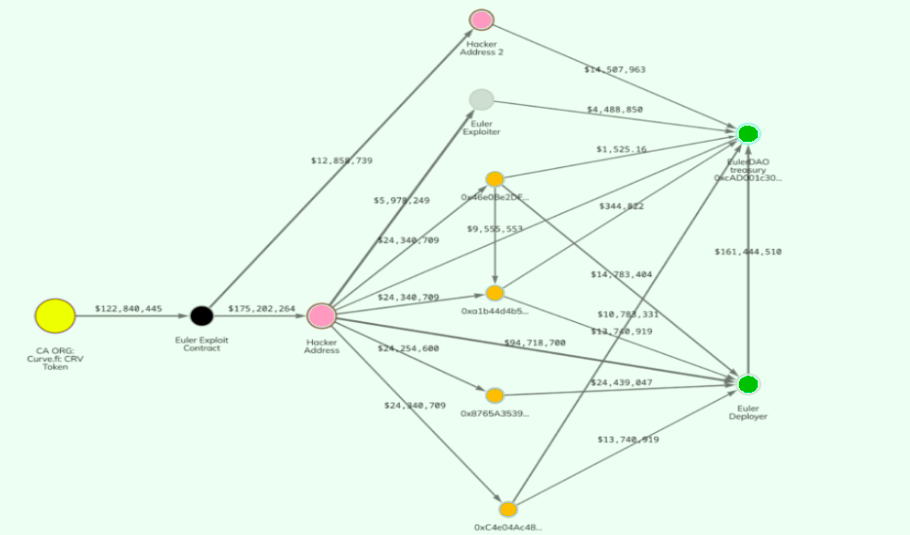

Smart Contract use of Require Statements; A Cautionary Tale

In March 2023, Euler Finance was hacked for $200 million, thereby drawing attention to one of the critical DeFi protocol elements: the importance of adherence to the core protocol invariants. Such an incident highlighted that developers must not focus only on the functional safety of a program but also should focus on ensuring that the…

-

What Are Intent Engines in Smart Contracts?

The Evolution and New Challenges Blockchain APIs are open by default, providing users with far too many choices in Web3 environments—a complexity that presents itself regarding optionality. Such a sea of decision trees and possible actions would best be explored by an automated system, requiring the user to be simply capable and not overwhelmed. Evolution…

-

How AI and Smart Contracts can Work in Harmony

Introduction to AI and Blockchain Integration So, we’re talking about mixing AI with blockchain, and it’s pretty much like adding a turbocharger to your car. It’s a game changer. OpenAI is leading the charge in shaking up a bunch of industries, and now it’s blockchain’s turn to get a makeover. Transforming Smart Contracts with AI…

-

How to do Smart Contract Testing

Introduction to Smart Contract Testing When we talk about smart contract testing, it’s like double-checking everything in your smart contract (which is just a fancy term for a self-running agreement that lives on the blockchain) to make sure it does what it’s supposed to do without any hiccups. Think of it as proofreading your essay…

-

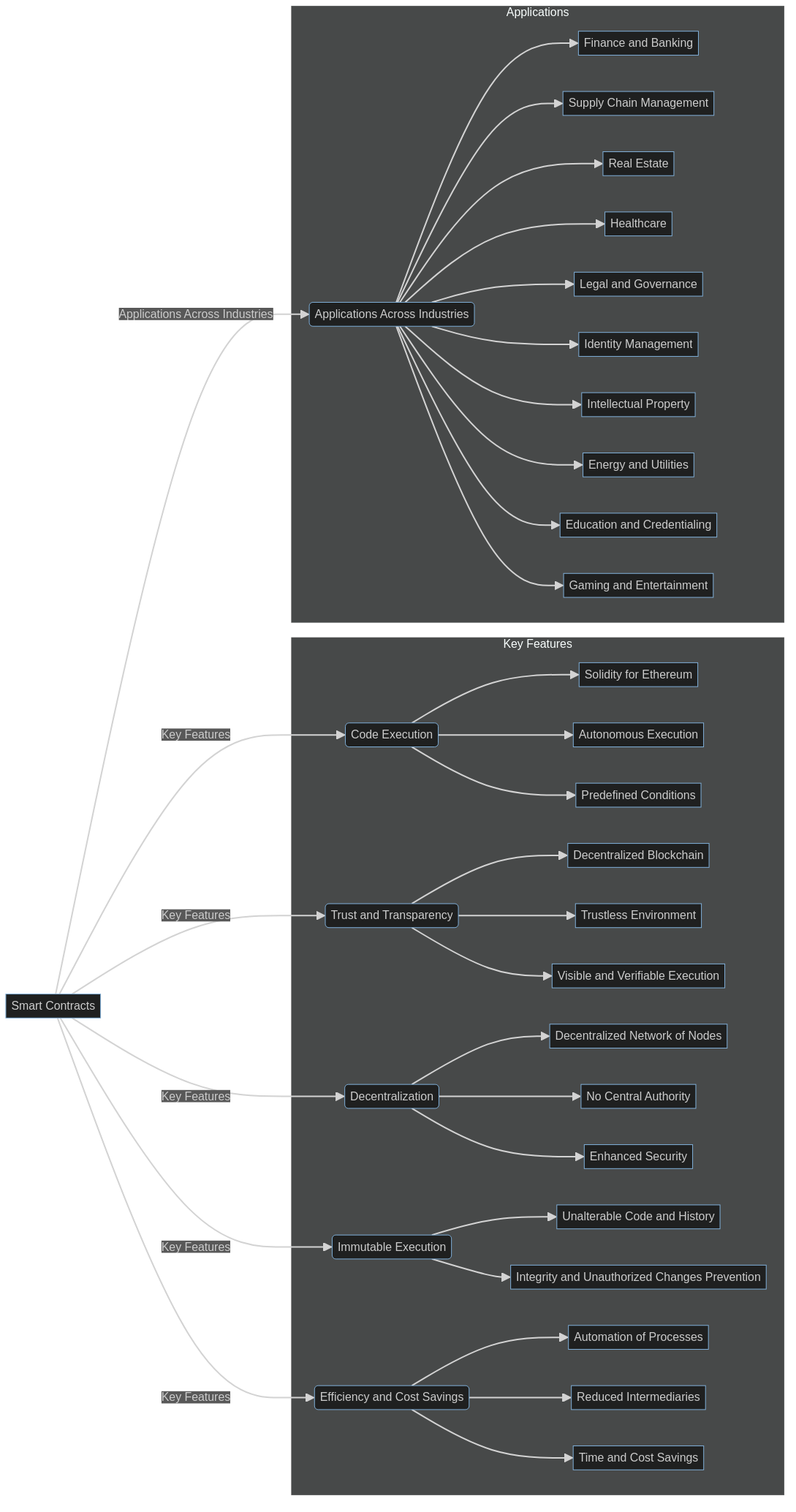

Smart Contract Diagram Key Features & Applications

This diagram outlines key features and applications of smart contracts.

-

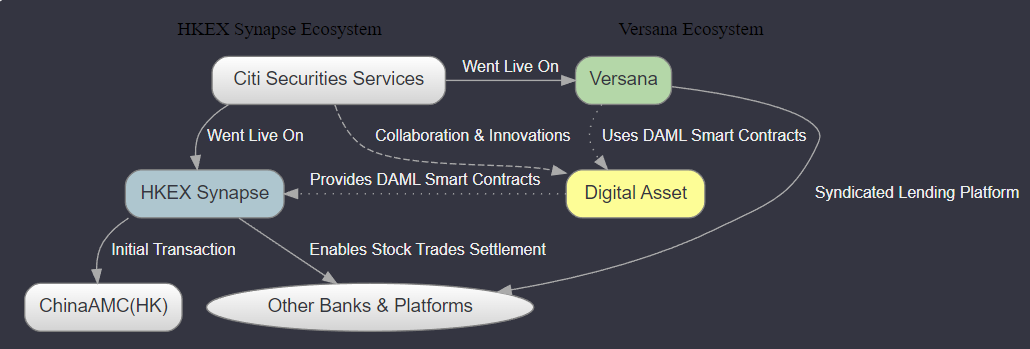

Citi Goes Live On Two Smart Contract Platforms for Equities, Loan Syndication.

To further enhance the effectiveness and protection of financial transactions in different areas, Citi Securities Services recently started to operate on two major smart contract platforms which could have a positive impact on the industry in terms of efficiency. HKEX Synapse: One of the platforms where Citi has linked its services with is HKEX Synapse…

-

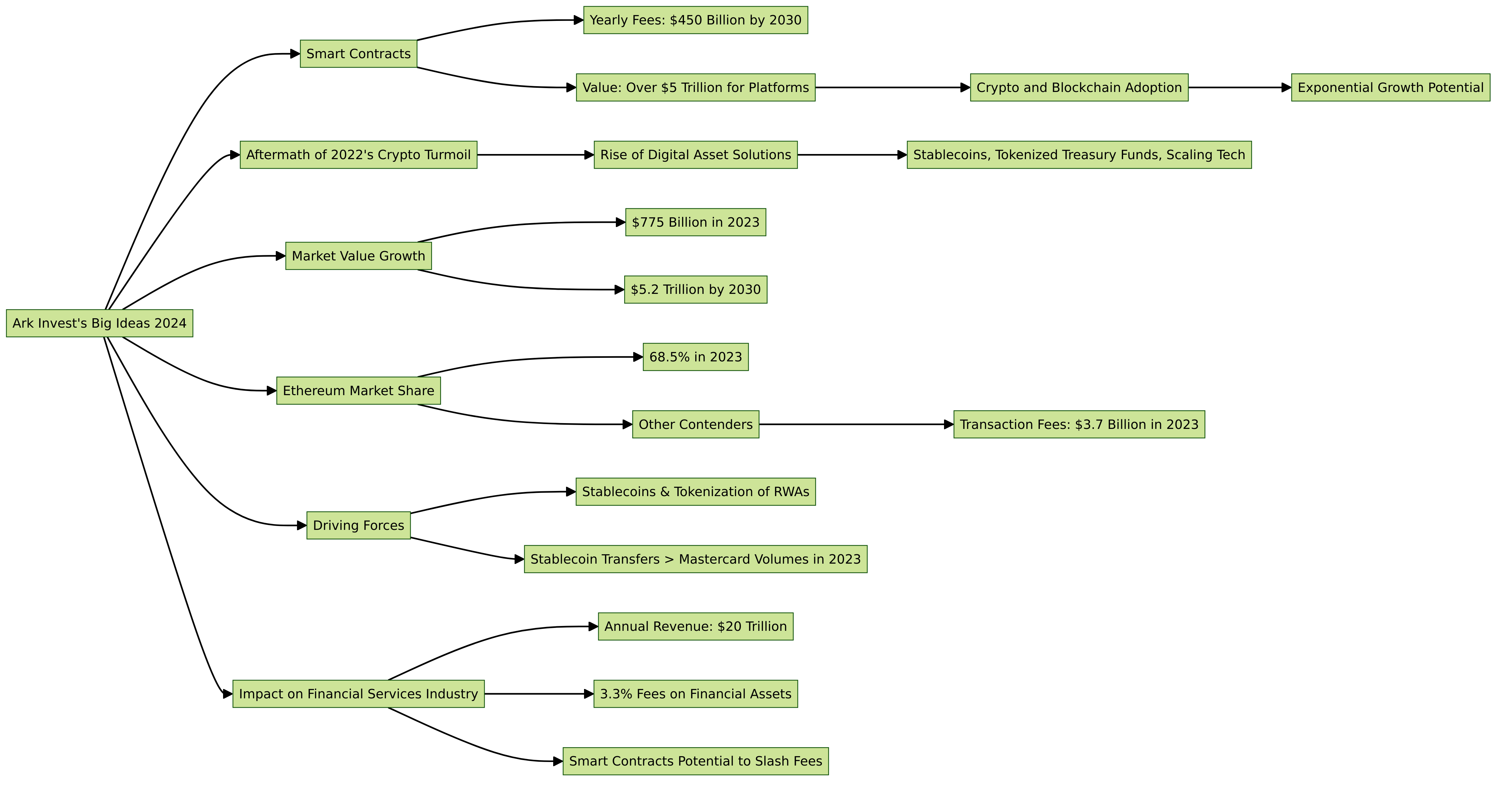

ARK Predicts Smart Contract Economy to Grow Massively

Ark Invest, a beacon in the investment world, has thrown its weight behind an audacious claim: the realm of smart contracts is on the brink of exploding into the trillions. Diving deep in their “Big Ideas 2024,” they serve up an eye-popping picture: smart contracts, those digital magicians; conjuring up $450 billion in yearly fees…