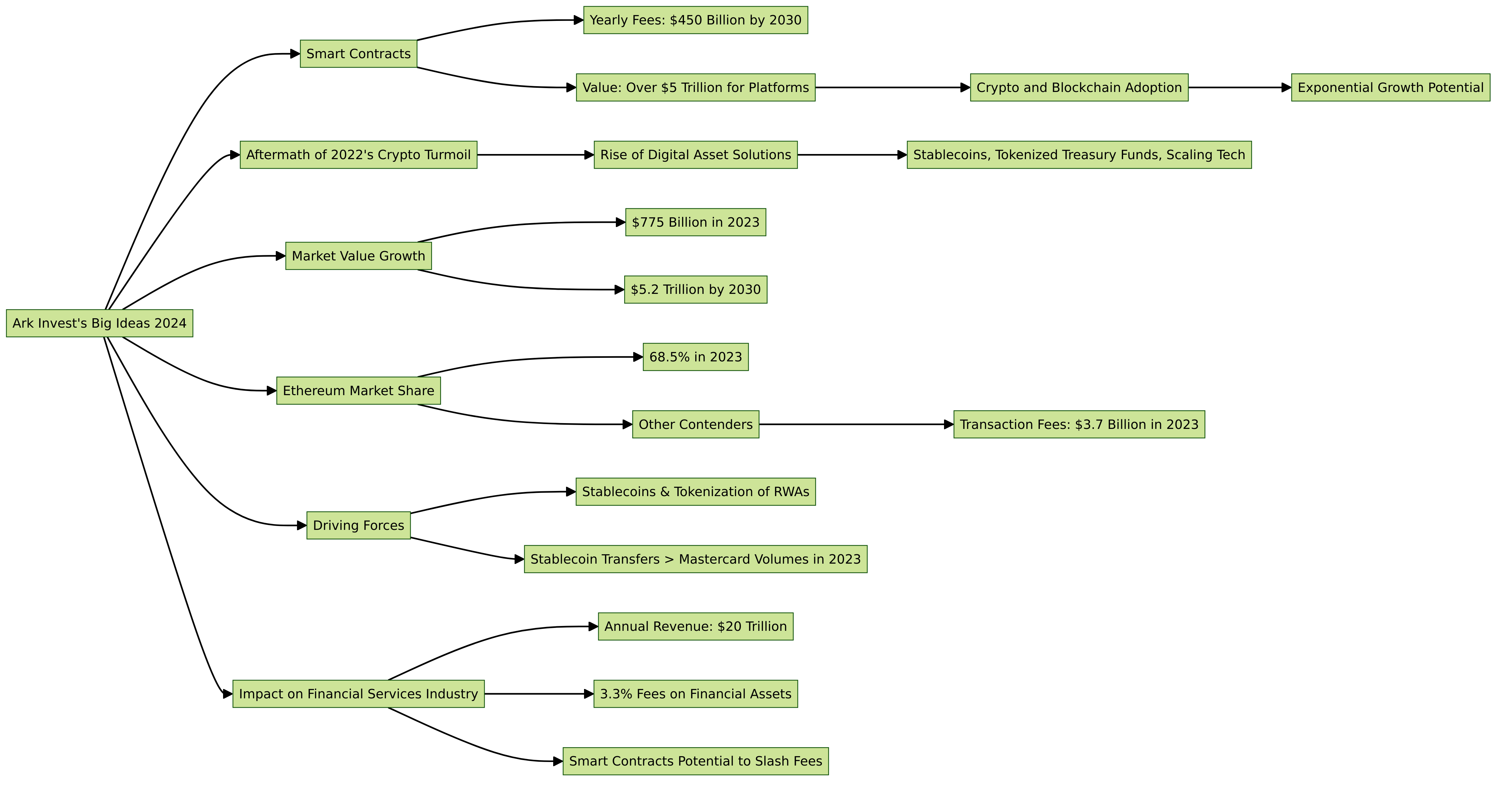

Ark Invest, a beacon in the investment world, has thrown its weight behind an audacious claim: the realm of smart contracts is on the brink of exploding into the trillions. Diving deep in their “Big Ideas 2024,” they serve up an eye-popping picture: smart contracts, those digital magicians; conjuring up $450 billion in yearly fees by 2030. This will bring in a tidal wave of value, over $5 trillion, for platforms that harness these smart contracts. It hinges on crypto and blockchain adoption taking a leaf out of the internet’s explosive playbook. Like the early internet, Ark believes smart contracts may catch people off guard because at first, the growth may be linear, but then accelerate into a parabolic growth curve.

Now, let’s navigate the aftermath of 2022’s crypto turmoil. Amid the chaos, a silver lining: the rise of digital asset solutions like stablecoins, tokenized treasury funds, and scaling tech, all powered by—you guessed it— smart contracts.

Ark’s eagle eyes have spotted a trend: as the stash of on-chain assets balloons, so does the market value pegged to decentralized apps (dApps). How big of a jump are we talking? A 32% annual climb launching from $775 billion in 2023 all the way to a staggering $5.2 trillion by 2030. Early days, yet smart contracts are already scripting a new chapter for the internet’s financial backbone.

Ethereum, the Goliath of digital contract networks, flexes its muscles with 68.5% of the market share among the top six contenders in 2023. Joining the fray are BNB Chain, Solana, Avalanche, Tron, and Polygon, together banking $3.7 billion in transaction fees in 2023 alone.

The driving forces behind this surge? Look no further than stablecoins and the tokenization of real-world assets (RWAs). Ark’s insights reveal a world where hyperinflation and global jitters fuel a skyrocketing demand for dollar-pegged stablecoins.

In the last three years, there has been a rush towards stablecoins, with every active address jumping by 93% on annual basis. By 2023, stablecoin transfers overtook those of Mastercards.

Ark does not stop at that. They consider smart contracts as a sledgehammer destroying the financial services industry’s nut. The sector is pulling in $20 trillion annually, just skimming 3.3% off financial assets worth. Smart contracts could do away with this overhead and change the economic landscape of the country.

Conclusively, Ark suggests a future where smart contracts are not just a cool trick but rather an entirely new way to create, own and manage online asset ownerships which can reduce high traditional financial sector fees. What about? It can pull off that feat by creating a more efficient but also an all-inclusive financial ecosystem

Leave a Reply