In principle, any contract which can be negotiated through a trusted third party (such as an auction or exchange) can be negotiated directly. So, in some abstract sense, the only remaining “hard” problems in smart contract negotiations are (a) problems considered hard even with a trusted intermediary (for the standard economic reasons), and (b) the task of algorithmically specifying the negotiating rules and output contract terms (This includes cases where an intermediary adds knowledge unavailable to the participants, such as a lawyer giving advice on how to draft a contract). In practice, many problems which can be solved in principle with multiparty computation will re-arise when we implement protocols in an efficient, practical manner. The God Protocols give us a target to shoot for.

The God Protocols

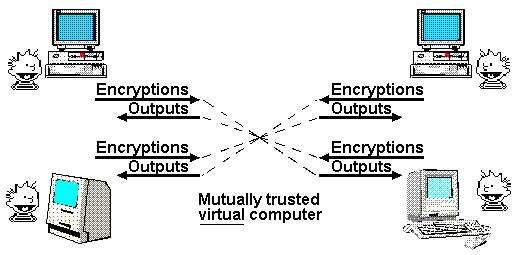

Back in 1997, Nick Szabo published his vision of the God protocol. An unbiased, mathematically trustworthy mediator that perfectly acts in the interest of all parties.

Since then, blockchain has come to provide an immutable, trust-less record where inputs can assemble and outputs be retrieved from. His fully-fledged vision goes much further than that—to a world where countless middlemen in our economy are freed from their dull and monotonous responsibilities. As predicted 22 years later, topics considered in The God Protocol have re-arisen with the advent of blockchain, smart-contract, and secure enclave technology. However, protocol sluggishness and lack of scalability in Szabo’s time remain problems with today’s blockchain:

The first is that this virtual computer is very slow: in some cases, one arithmetic calculation per network message.

The God Protocols

Chainlink has come to address this issue, allowing for computation off-chain while still retaining much of the integrity blockchain provides. Trusted execution environments on the network allow for secure, verifiable processing with much better scaling.

Chainlink’s Town Crier solution also addresses the problem of confidentiality in a smart contract network, finally bringing to fruition a key part of Szabo’s vision:

If mutually confidential auditing ever becomes practical, we will be able to gain high confidence in the factuality of counterparties’ claims and reports without revealing identifying and accompanying information from the transactions underlying those reports.

Knowing that mutually confidential auditing can be accomplished in principle will hopefully lead us to practical solutions to these important problems.

The God Protocols

Intel SGX in conjunction with Town Crier does allow auditors to assess if the user’s application meets specifications and standards. It can then can generate final binaries, and sign them for audit. Enclaves may also process data from sources confidentially, managing sensitive information like user credentials. Many smart contract use-cases are null and void without this protection of privacy.

Szabo’s Hurdles

With the base layer(protocol-level) requirements solved, some higher level software hurdles remain, but are perhaps within reach.

Szabo goes on to illustrate the first remaining problem: “(a) those considered hard even with a trusted intermediary”. He may be referring to arbitration, indemnification, standards of proof, force majeure, and other legal sections that would be difficult to codify in a smart contract. Or, where “human trusted third parties provide insight or knowledge that cannot be provided by a computer.” In contrast with operational clauses, these situations are classified as “Non-operational” according to the International Swaps and Derivatives Association:

Operational clauses generally embed some form of conditional logic – ie, that upon the occurrence of a specified event, or at a specified time, a deterministic action is required.

Non-operational clauses do not embed such conditional logic but that, in some respect, relate to the wider legal relationship between the parties.

ISDA

One example of a non-operational clause is when a party to a contract is required to act in “good faith” or use “reasonable care”. These terms have legal meaning, but are clearly not boolean. What these terms mean is subjective and hard to codify in a way that makes sense. People tend to have varying standards along a spectrum of rigidity and leniency. Many interpretations of law are highly contextual, factoring in the unique circumstances of the case.

Take the example of a standard representation from a party that it is duly organized and validly existing under the laws of the jurisdiction of its organization or incorporation. This is not a statement of conditional logic, and so would not be susceptible to pure Boolean logic. It is a representation of a legal state. But if there were a sufficiently developed ontology for legal contracts, it would be possible to conceive of a world where a computer could understand what is meant by the terms ‘party’, ‘duly organised’, ‘validly existing’, ‘jurisdiction’ and ‘organisation and incorporation’, and could check automatically with relevant company registries whether this representation is correct at the time it is given.

ISDA

Since machine learning has made great progress writing convincing essays and poetry, it’s not unreasonable to think it may be applied to law in the future. Taking the ISDA’s conception a step further, there are millions of case-law records and judgements available for machine learning to develop ontology and reasoning from. Where cost savings outweigh the risks, future A.I. judges may only need to prove it can track alongside human ones at a reasonable rate greater than chance.

Robo-arbitration may be a method for non-operational clauses to be handled in a smart contract. This would be an ideal use-case for Town Crier’s trusted execution environments since the high compute cost would necessitate that it be run off-chain. It would also ensure the integrity of the robo-arbitrator. Innovation in this field has already begun in earnest. For example, Blue J Legal provides such software as Tax Foresight, which uses machine learning to predict how a court would rule in clients various tax scenarios. Such integration on a smartcontract network could prove a powerful tool in reducing the cost of litigation.

The second piece to the puzzle mentioned by Szabo, “(b) specifying the negotiating rules” could be solved at least in part, by a growing library of legal templates such as those offered by Openlaw and the Accord Project. These allow for reliable contracts to be deployed easily and with recommended and customizable parameters.

The Chainlink whitepaper also mentions an optional “escape hatch” to be used by authorized contract administrators in the event of an unforeseen bug or vulnerability. Again, these can be set up in a number of ways at the discretion of the smart contract users.

An oracle is, a translator for information provided by an outside platform. Oracles provide the necessary data to trigger smart contracts. The other factors which “specify negotiating rules” are how and what oracle feeds are used in determining smart contract outcome(s). The flexibility and security of which has been solved comprehensively by Town Crier:

TC can also perform trusted off-chain aggregation of data from multiple sources, as well as trusted computation over data from multiple sources (e.g., averaging) and interactive querying of data sources (e.g., searching the database of one source in response to the answer of another).

Chainlink White Paper

Today there are contracts that would theoretically be desirable, but are too costly and slow to be implemented in a traditional manner. For example, insurance contracts that need a minimum size to cover administrative and enrollment costs. Still there are other cases where contracts are violated but the cost of litigating them are too high to pursue. These are ideal niches where standardized smart contracts may flourish.

Another niche may be found in developing countries. Just as the anti-inflationary properties of crypto helps citizens of unstable regimes, a substitute legal system might also be used where property rights and rule of law are weak. Sergey Nazarov echoed this in a 2014 interview:

In the current system many businesses can raise money and make promises they won’t keep. Because they realize the banking or legal infrastructure is flawed. In the future, people will simply make a smart contract.

Sergey Nazarov

Modern smart-contract discussion conjures up thoughts of an almost magical process where automation takes over. Panels ask, “Are we getting rid of lawyers?”. The answer is categorically no. It just means fewer people working in back-offices pushing paper; which will likely be balanced with new jobs in implementation and maintenance of smart contracts themselves. Lawyers will be freed up to draft contracts and litigate the most complex cases and where human discernment is necessary. The focus would shift towards choosing and calibrating a growing library of legal templates. These changes will further be accelerated by the official recording of registration, identity, and property rights on blockchain.

Conclusion

The God Protocol is here, and with it, a new era of the internet has begun. A promising shake-up of legal systems around the world, cutting down corruption and unlocking billions in productivity. Adoption could take decades and will no doubt have its skeptics, but it seems a system closely resembling Szabo’s vision is now inevitable.

Leave a Reply